Happy New Year, Readers. It’s time to say ‘tis the Season. No, not that season—it’s TAX SEASON!

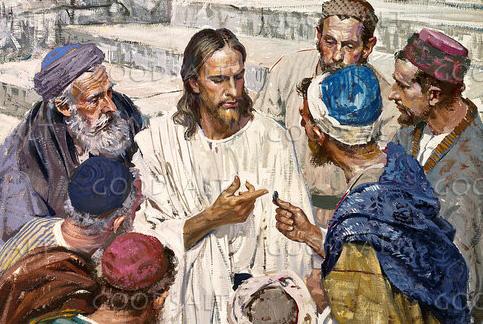

Tax season involves long hours at the office with little to no time for anything other than work. But it also becomes a time of year where gratitude reigns in my life. I have opportunities galore to speak about the blessings in my life with clients. A wise man once said Give to Caesar what belongs to Caesar, and give to God what belongs to God (Matthew 22:21, NLT). This verse came to me several years ago shortly after I started my own tax practice and realized I was going to be having the “I just prepared your tax return and unfortunately you owe the IRS” conversation more than once. Prior to hanging out my shingle, I worked at a tax firm, and it was the firm’s partner who met with clients and delivered bad news while I worked anonymously in a little cubicle in the back office churning out tax returns.

Over the years I have delivered the ‘you-have-a-tax-liability’ news many times over. The news can be met with anger and resentment. Occasionally people cry. Being a highly sensitive person in nature sometimes I cry with them because I personally know sometimes writing that check to the taxman means you are giving something up you’ve been looking forward to, like a family vacation. And what goes with that is the disappointment of having to spend the savings you’ve worked so hard and sacrificed so much to attain.

While it appears, it is no longer politically correct these days to mention God for fear of treading on people’s individual beliefs, “giving to Caesar” is, in the end, something we all have to do (except if you are Amazon—more about that another time). But what I can also do is acknowledge the second part of the verse— “what belongs to God.” What belongs to God? Everything else. I point out to clients that the IRS can take your money but that’s all it can take. It’s only money. I encourage them to focus on what really matters to them. I then affirm all the blessings in my life. My teenager is relatively happy most of the time, which is a small miracle. My husband works hard and is incredibly supportive. I am blessed with a 10-minute morning commute from home to the office. As a community we live in one of the most beautiful places in the world, a place where people flock to vacation every year. The ocean and the forest are in our backyards. To me all these things belong to God. I just get to enjoy them while I’m here on earth. No one, not even the IRS, can take away any of our blessings. What about you? What riches fill your life? Find the blessings and affirm all that is good in your life. If you are like me and have had to overcome adversity and challenges in life, you come to realize paying taxes is a “have to” and the rest of life is a “get to.”

A reader asks:

I got divorced a couple of years ago and in the final settlement my ex-husband walked away with almost everything. I didn’t do anything wrong but somehow, I got stuck with a huge tax bill afterward. I read about the term Innocent Spouse relief in your article last month and that I might not have to pay the tax bill. Would I qualify?”

Outstanding question! As a Tax Resolution Specialist, I often speak in “tax lingo” and then realize how easily these terms can be misconstrued. Unfortunately, that was the case for this reader. I found out her tax bill was mainly attributed to bad legal representation and new tax rules. The term Innocent Spouse relief pertains to an IRS rule that provides you relief from taxes you owe if your spouse (or former spouse) failed to report income, reported income improperly or claimed improper deductions or credits on a joint tax return you signed not realizing what had transpired (IRS Topic No. 205).

By requesting this, you can be relieved of responsibility for paying taxes, interest, and penalties. Being granted innocent spouse relief is not especially complicated but the rules can be tricky. If you find yourself with a large tax bill you thought your spouse or former spouse had paid and have questions, please consult a licensed tax professional.